Not known Details About Mortgage Refinancing Options

Table of ContentsGetting The Mortgage Refinancing Options To WorkHow Mortgage Refinancing Options can Save You Time, Stress, and Money.What Does Mortgage Refinancing Options Do?All About Mortgage Refinancing Options

What You Ought To Know Prior To Refinancing Getting a brand-new home mortgage to replace the original is called refinancing. Refinancing is done to permit a customer to obtain a better rate of interest term and also price. The first loan is repaid, enabling the 2nd funding to be produced, rather than simply making a new home mortgage and tossing out the original mortgage.Without the ideal expertise it can actually hurt you to refinance, boosting your passion rate rather than reducing it. For relative objectives, here is a rate table highlighting existing rates in your area.

Often, as people overcome their professions as well as remain to make more cash they have the ability to pay all their expenses promptly and also thus increase their credit report. With this rise in credit report comes the ability to acquire fundings at reduced rates, and for that reason lots of people refinance with their mortgage companies because of this.

Calculate Your Monthly & Complete Rate of interest Financial savings Our shows how much you can conserve securing in lower rates. Second, lots of people re-finance in order to acquire cash for big purchases such as automobiles or to decrease credit rating card debt. The means they do this is by refinancing for the purpose of taking equity out of the residence.

The Best Guide To Mortgage Refinancing Options

The balance owed on the original home mortgage is deducted. After that money is made use of to pay off the initial home mortgage, the continuing to be equilibrium is loaned to the property owner.

Therefore, they raise the worth of the home. By doing so while making payments on a home loan, these individuals have the ability to take out significant home equity credit lines as the distinction in between the assessed value of their house increases and the equilibrium owed on a home loan reduces.

Many people re-finance when they have equity on their house, which is the difference in between the quantity owed to the mortgage firm and the well worth of the house. Exactly How Many Types of Refinancing Exist? House owners can choose to re-finance for a selection of factors consisting of: Money Out Residence Equity Homeowners can remove equity from the homes.

If the equity is removed to spend for house fixings or significant home enhancements the interest expense might be tax obligation deductible. Adjustment Funding Duration Homeowners can shorten period to pay less rate of interest over the life of the funding & possess the residence outright quicker; lengthen the period to lower regular monthly repayments.

Mortgage Refinancing Options Fundamentals Explained

Lots Of FHA or USDA debtors who boost their credit accounts & revenue later on shift into a traditional lending to eliminate the considerable regular monthly mortgage insurance settlements. The adhering to graphic checks out examples of why a resident might choose to refinance. What are the Alternatives to Refinancing Your Home? Instead than refinancing their home in whole, some home owners who have accumulated substantial equity & currently enjoy a low-rate car loan can make use of a house equity loan or credit line to touch their equity without resetting the price on the rest of their existing financial obligation.

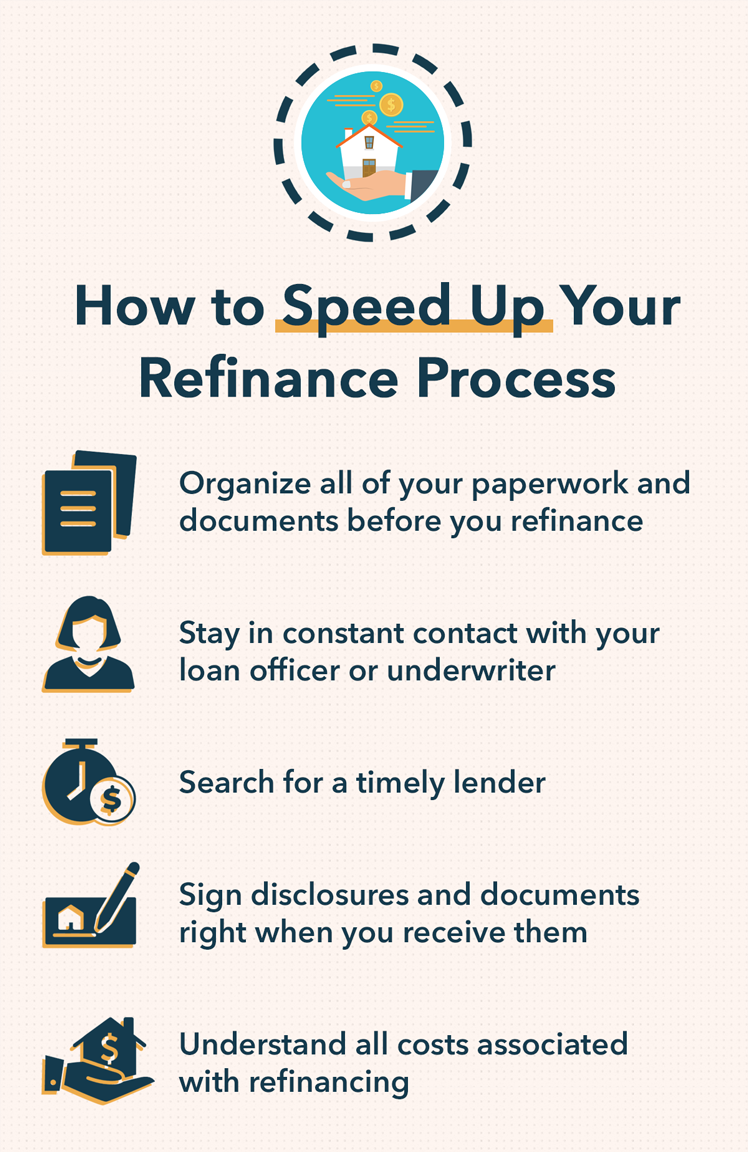

Prior to finalizing the agreement for refinancing, make certain it covers the charge and also is still worthwhile. Along these very same lines, there are added costs to be familiar with before refinancing. These prices consist of spending for a lawyer to guarantee you are obtaining one of the most valuable deal feasible as well as manage paperwork you could not really feel comfortable submitting, and bank fees.

Compared for cash you may be receiving from your brand-new credit line, however saving countless bucks in the lengthy run is always worth taking into consideration. What Do I Do to Re-finance? The very first thing you should do see this site when thinking about re-financing is to take into consideration specifically how you will certainly pay off the financing.

9 Easy Facts About Mortgage Refinancing Options Explained

On the other hand, if the credit is going to be made use of for another thing, like a new automobile, education, or to pay down debt card financial obligation, it is best to take a seat and propound paper precisely just how you will certainly pay off the finance (mortgage refinancing options). Also, you will certainly need to contact your home mortgage company and review the choices readily available to you, in addition to reviewing with various other home mortgage firms the choices they would certainly offer.

As a result, it remains in the finest rate of interest of the borrower to talk to the specific lender for all restrictions as well as information. try this website In most cases, it makes the most sense to refinance with the original loan provider, but it is not required. Bear in mind though, It's less complicated to maintain a customer than to make a brand-new one, many lenders do not require a new title search, residential or commercial property assessment, etc

So odds are, a far better price can be acquired by remaining with the initial loan provider. mortgage refinancing options. Reasons for a Debtor to Re-finance Consumers may take into consideration re-financing for numerous various reasons, including however not go now restricted to: To reduce the overall payment and also rate of interest, it might make good sense to pay a point or more, if you plan on living in your house for the next numerous years.

On the various other hand, if a debtor is intending on a transfer to a brand-new residence in the future, they might not be in the residence long enough to recover from a mortgage refinance and the expenses related to it. As a result, it is very important to calculate a break-even point, which will aid determine whether or not the refinance would be a sensible option.